What is Yearn Finance Coin? YFI Fundamentals Review For Beginners!

Comprehensive Educational Review of Yearn Finance (YFI) Coin: Understanding Features, Governance, and Yield Opportunities

By reading the article “What is Yearn Finance Coin” published in Adaas Investment Magazine, you will get acquainted with the YFI token and what are the risks and benefits in general. This level of familiarity can be enough when you need educational information about this topic.

The podcast is published for you!

This is not an investment suggestion!

We do not persuade anyone to invest or not invest in any asset.

Table of Contents

Introducing Yearn Finance Coin

The Yearn.Finance platform is a collection of decentralized finance industry or DeFi products, developed to provide returns services such as Yield Farming on the basis of smart contracts of Ethereum.

What is DeFi?

The word “DeFi” stands for “Decentralized Finance” and refers to a decentralized financial system. Decentralized finance means the removal of intermediaries such as banks, organizations, and legislatures from the international financial system.

The different parts of the Yearn Finance platform are controlled by different people and the selection and implementation of decisions related to each part are managed according to the protocol of the governance token and the native token of this platform, YFI.

Introducing Yearn Finance platform products

As mentioned earlier, this platform offers products in the decentralized finance industry, the most important of which we have introduced below.

You can also read more about the products offered by the Year.Finance platform via the link below.

Vaults

Capital pools automatically provide maximum returns for investors based on market opportunities. This product increases the profit of the members participating in the Vault product by reducing the cost of commissions, automating the Yield processes, and automating the transfer of capital in the appropriate situations.

Simply put, investors do not need the knowledge to work with decentralized finance platforms, and this product provides them with maximum returns.

EARN

The main goal of this product is to increase the maximum efficiency of the lending process through automatic capital transfer in AAVE, DYDX, and Compound platforms. Simply put, it is an aggregator of lending platforms where users can ensure that in any situation they make the most profit by investing their capital in the lending process on these platforms.

An example of the EARN product

Imagine you want to deposit a stable coin like USDC in one of the pools of lending platforms like Compound and receive a reward. The EARN product helps you to automatically transfer your USDC tokens between DYDX, AAVE, and Compound lending pools for the highest rewards rate.

What is the main purpose of Yearn Finance?

By now, you must be familiar with the performance and purpose set by the Yearn Finance platform and its products. Many cryptocurrency market investors decide to invest in cryptocurrency trading instead of DeFi because of the complexity of processes such as Yield Farming to make a profit.

What is Yiled Farming?

Yield Farming is a strategy for making money from cryptocurrencies. In the Yield Farming strategy, individuals have rewarded a fee for lending their cryptocurrencies through smart contracts and platforms that offer Yield Farming.

Solving this problem by any platform will bring huge benefits to it. The Yearn.Finance platform, with products such as Vaults and Earn, seeks to make investing in decentralized finance industry processes as easy as possible for its investors and has been very successful.

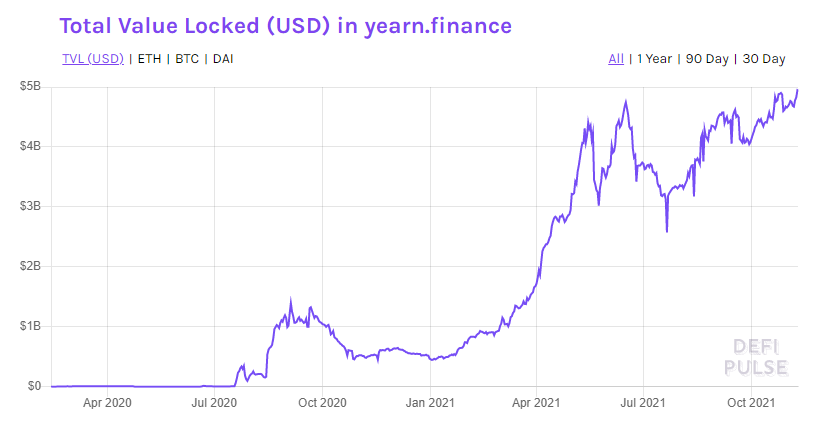

As you can see in the image below, the Yearn.Finance platform managed nearly $5 billion with its products on November 9, 2021, which is a testament to the success of the decentralized finance industry and the Yearn Finance platform.

You can use the following link to view statistics related to the value of locked assets in all versions of the Yearn.Finance platform.

How does Yearn Finance work?

The Yearn.Finance platform is not very complex, unlike some large projects in the decentralized finance industry. But at the same time, they have not released enough documentation on how the platform works, which makes the exact description a bit erroneous.

Simply put, the platform seeks to maximize the benefits of the lending process for its users by automatically transferring funds between the DYDX, Compound, and AAVE platforms. When a StableCoin is invested in the Yearn Finance platform, a Y is placed as a prefix before the StableCoin name. Thus, if the USDC token is deposited, its name will be changed to yUSDC and it will be called the optimized yield token.

Introducing the founder of Yearn Finance.

The creator of the Yearn.Finance platform and its unique products that made it easy for everyone to invest in the decentralized finance industry is Andre Cronje, a smart computer science student.

After completing his university studies, Mr. Cronje entered the private sector and the fields of finance, insurance, and blockchain. He was also so good at analyzing cryptocurrency codes that he was listed on the Crypto Briefing website as the winner or loser of a project.

After finding the big problem of not interacting easily with decentralized finance industry platforms, he decided to develop the Yearn.Finance platform to simplify this interaction as much as possible. He first used his personal funds and close acquaintances and then realized the huge demand for his platform. He also claims to be the first to invest in the platform and the last to withdraw.

If you want to read all the members of the Yearn.Finance development team, you can see the official members of this company through the link below.

Review of governance process in Yearn.Finance

The affairs and decisions of this platform are taken and executed by governance tokens. This way, YFI token holders can vote positively or negatively for these changes.

The difference between Yearn.Finance and other platforms that use the governance token mechanism to manage their affairs is that only YFI token holders who have deposited their assets in the yGov governance pool have the right to participate in the voting process. Of course, you should note that YFI tokens cannot be deposited in this pool, and users must bear the almost high risk of obtaining BPT tokens by depositing their assets in the Yearn.Finance platform products.

To read additional information about how the governance token mechanism works on this platform, use the following link:

Yearn Finance Tokenomics Review

Yearn Finance coin has introduced its token under the name YFI to the cryptocurrency market and this token can also be transferred under the Ethereum blockchain.

Token Distribution

The official YFI documents indicate a maximum supply of 36,666 tokens, all of which are currently in the market cycle. For a fair distribution of these tokens, no amount was allocated to the development team or investors and all tokens were distributed among users.

The distribution of all the tokens lasted for 9 days, and first 10,000 YFI tokens were allocated to the liquidity providers in the Curve decentralized exchange and then 20,000 YFI tokens for the two pools in the Balancer decentralized exchange.

To read detailed and additional information about the distribution of Yearn.Finance platform tokens, enter the official dashboard via the following link:

Applications of YFI token

As mentioned, one of the most important uses of the YFI token is to govern and manage the Yearn.Finance platform. In this platform, each YFI token is calculated to equal one vote. All submitted proposals require at least 33% of YFI token holders to agree to it.

You can also use the following link to read additional information such as YFI Token Smart Contract information:

How to earn YFI and YFII tokens

Yearn.finance has been forced to create a new fork called YFII after failing to get the minimum number of positive votes for YFI changes. The distribution method of this token is the same as the YFI token and the only difference is the maximum supply of 6,000 YFII token units.

There are 3 suggested strategies for earning YFI and YFII tokens, which are:

- By depositing YFI and DAI tokens with a ratio of 98 to 2%, YFI tokens can be earned in Balancer decentralized exchange pools to receive BAL tokens as a reward and deposit them in yGov pool.

- By depositing the yCRV token, which is obtained through the liquidity providing process in the Curve decentralized exchange, YFI tokens can be earned in the yGOV pool.

- YFI tokens can also be earned by depositing a combination of YFI and yCRV tokens in the Balancer decentralized exchange pools and earning a reward in the form of a BPT token and depositing it in the yGov pool.

Yearn Finance roadmap review

Given that the platform has just entered the cryptocurrency market and the official roadmap has not been published in the official documents, to follow the latest news related to it, one should follow the official page of its founder, Andre Cronje, on the Medium platform.

After updating the first version, Yearn.Finance V1, the development and founding team of this platform decided to change the governance structure of this platform. Other changes to the platform in its second version, Yearn.Finance V2, includes the addition of gamification strategies and more assets to encourage other investors.

Simply put, due to the use of the governance token mechanism in the Yearn.Finance platform, all holders of this governance token can submit their suggestions for changes and updates, and if the voting users agree, the update will enter the implementation phase.

The founder of the Yearn.Finance platform said in an interview that updates are really fast and they will run an update and upgrade on the platform in less than a few weeks.

Yearn Finance coin investors

Yearn.Finance platform has gained the trust of many professional investors as well as small traders after proving its performance. In this article, we have introduced 4 big investors in this project for you.

Where can buy or sell Yearn Finance coin

As you have read, YFI tokens can be transferred under the Ethereum blockchain, and also due to the high popularity of this platform among investors, YFI tokens can be bought and sold in centralized and decentralized exchanges below.

- Binance

- Coinbase

- FTX

- Uniswap

- Sushiswap

Also, You can visit the Yearn Finance cryptocurrency profile at CoinMarketCap.com to view the latest updates from exchanges that support this token trading and check their inventory through the following link.

The end words

At Adaas Capital, we hope that by reading this article you will be fully immersed with What is Yearn Finance Coin. You can help us improve by sharing this article which is published in Adaas Investment Magazine and help optimize this article by submitting your comments.

Resources

FAQ

What Is Yearn Finance Coin?

The Yearn.Finance platform is a collection of decentralized finance industry or DeFi products, developed to provide returns services such as Yield Farming on the basis of smart contracts of Ethereum.

Where to trade YFI token?

– Binance

– Coinbase

– Uniswap

Hi my family member! I want to say that this post is awesome, nice written and come with approximately all vital infos. I would like to peer more posts like this .

Neat blog! Is your theme custom made or did you download it from somewhere? A design like yours with a few simple tweeks would really make my blog stand out. Please let me know where you got your theme. Many thanks